Grafton Banks Finance team say it's business as usual

28th June 2016

As the dust continues to swirl on what has been a historic few days in the UK, fear tactics have rapidly shifted to the fears of reality, and the uncertainty that has engulfed a post-Brexit Britain. The current mood is understandable, but so is the importance of unity, strength and a positive outlook as businesses in all sectors enter a new chapter. Our consultants at Grafton Banks Finance will listen to your needs and requirements and work in partnership with you to ensure that you make the right career move - business as usual.

A different outlook

Despite concerns, we are still left with the same landscape we had, but with a different outlook that we must all seize to succeed - a statement which will become more apparent once the country regains stability.

Low business rates have drawn world-class businesses and talent to UK shores. Prior to the decision on 24 June, UK employment had risen to 31.5 million, the highest rate since records began in 1971, according to the Office for National Statistics. The economy maintained general stability, employers remained confident and wages continued to creep upward, all in the midst of EU referendum jitters. The Institute of Directors (IoD) recently surveyed 1,000 of its members to ascertain how its community is reacting to the news. Almost a third would keep hiring at the same pace and 75% claimed that they will not freeze recruitment.

"Knee jerk" reactions and hyperbolic headlines in light of Brexit were inevitable considering the gravitas of the situation, but climbs in the economy, employment and the stock market in the first six months of the year has helped to cushion the biggest blows that have unfolded so far. David Kern, from the British Chambers of Commerce, said, "The economy may not have softened as much as feared in the early months of 2016. Our flexible dynamic labour market remains a source of strength for the UK economy."

Markets are markets

Once we all separate media opportunism from the realities of business in the UK, the truth is that markets are markets; the world is the same today as it was yesterday. George Osborne moved to reassure the markets on 27 June, seeking to calm nerves within the financial markets in particular. In his speech to UK markets he claimed that Britain is "ready to confront what the future holds for us from a position of strength", which has been reiterated by Mark Carney who spoke well about the Bank of England's response, and seems to be well prepared to guide us through this uncertain time. We agree with this positive outlook, and the importance of readjusting our future plans to meet the demands of today's climate.

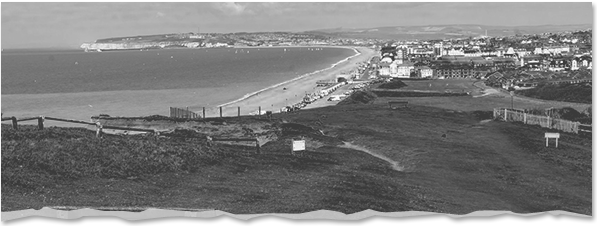

It is now crucial that a solid plan for post-EU Britain is now forged and that prolonged uncertainty must be handled carefully by the next Prime Minister. The UK has a strong economy, with robust pockets of economic growth that define our country's diversity and ingenuity. The small business sector in Sussex - which is the backbone of the local economy - are looking to expand and create new jobs with an additional £2.4 million from the Business Growth Grants Programme and nearly £153,000 of Rural Development Programme funding - which was recently awarded to rural businesses in West Sussex.

When we spoke to businesses in our area prior to the vote, many said that it would not affect them particularly one way or another. Of course everyone is affected by an unstable economy but businesses need accountants, and as we saw from setting up in a recession, life goes on.

We understand that for many businesses around the country the result will have an operational impact after years, or even decades, of perseverance and hard work. What we say to our clients in the financial industry is that history has taught us to play to our strengths in times of uncertainty. This event will require the skills and foresight of professionals who have continued to strive for excellence during times of recession, and a confident message that time will heal short-term wounds.

Our consultants have extensive knowledge and experience of the Finance industry and have recruited from Part-Qualified to Finance Director level into Commerce & Industry, Accountancy Practices, Public Sector, Financial Services and Legal Firms.

Grafton Banks was established in 2008, just as the economy was plummeting into one of the worst recessions in living memory. The team steadily grew the organisation by employing a confident belief in our abilities and industry, and we will do the same now. For an in-depth and confidential consultation about jobs and careers in finance please contact Nigel Jeyes on 01273 229499 or email nigel@graftonbanks.co.uk. We look forward to hearing from you.

How to pass a recruitment aptitude test in less than 500 words

UK Wage Growth: what needs to happen?